By Eric Reich

Challenging times become even more so when they also affect your money. Times of uncertainty make us second-guess many of the things we know to be true. The difficulty lies in the nearly endless barrage of 24/7 media coverage, which as we all know is almost never positive.

So, how do we protect ourselves financially during this time? For starters, we want to avoid the biggest mistakes we can make during times like this. Here is a list of the “big five” mistakes that investors need to avoid in order to keep their finances on track during times of trouble.

1. Stopping your retirement plan contributions

This one is particularly damaging because contributing during a decline is often the fastest way to recover what you have lost. If we look back to the financial crisis of 2008, it took investors on average five years to recover what they lost from the market decline. If those same investors were contributing to a retirement plan all along, that time was cut in half to only 30 months! Why? Contributing during a decline allows you to make purchases when prices are lower, which reduces the overall costs of the investments you buy. For example, if you bought a stock at $100 and it lost 50% of its value, it’s now worth $50. If you bought the same number of shares at the new price of $50, then you only need the total investment to get back to $75 in order to break even. Anything above $75 is now a profit for you. On the contrary, you would have to wait for it to get back to $100 if you bought no additional shares at the discount.

2. Reducing your risk after the market already drops

While some people continue to make contributions to their retirement plans during a crisis, they often make the mistake of reducing the risk while they are making those contributions. I would argue that they should do the exact opposite. You can maintain the investments for the existing balances in your account, but new contributions should probably be made into more aggressive funds to capitalize on the prices that were most affected — the more aggressive funds. Those are the funds that are likely to grow the most over the coming years after the crisis has passed. The tendency to want to “protect what’s left” is exactly what will end up hurting you more in the long run.

3. Forgetting about fees, taxes, expenses and budgets

During a crisis, we tend to focus so much on the crisis itself that we often overlook all the little things that can really add up to big things. For starters, one way to minimize the impact of portfolio declines is to make sure you aren’t making the problem worse by not being as tax-efficient as possible with your investments. Adding high taxes to a portfolio that is losing money only compounds the problem. Likewise, paying unnecessarily high fees also adds to the problem. If you are withdrawing funds from your portfolio during a market decline, you are creating negative compound interest. The lower the account value, the larger the percentage that you need to withdraw in order to maintain the same income. This causes you to spend down your principal at an even faster rate. This is a great time to review your budget and see if there is a way to cut out any unnecessary expenses to minimize the amounts you take out when the account value is down. Small reductions in your budget can add up to substantially larger portfolio balances down the line due to minimizing the negative compound interest effect.

4. Waiting for “the sign”

Many investors want to wait for “the sign”. This is the point where something indicates to them that now is a good time to get back into the market. While waiting for this “sign”, we often miss out on a significant portion of the recovery because you never really know which “sign” is the real one. I often ask investors, which piece of data are you hoping for to tell you what you want to hear? Is it the jobs report? Consumer confidence? Manufacturing? Unemployment? Unfortunately, countless pieces of data come out on an almost daily basis, and any one or none of them can signal a return to “normalcy”. If we look back to March 9, 2009, which was the bottom of the market for the financial crisis, we see that there was no good news, no positive data, and no feel-good information that led the markets to turn around that day. They simply started moving higher. Sadly, many investors waited months, if not years, to “feel confident” that the market was doing better and that the rally was sustainable. This caused them to lose significant returns because they simply never heard what they were hoping to hear.

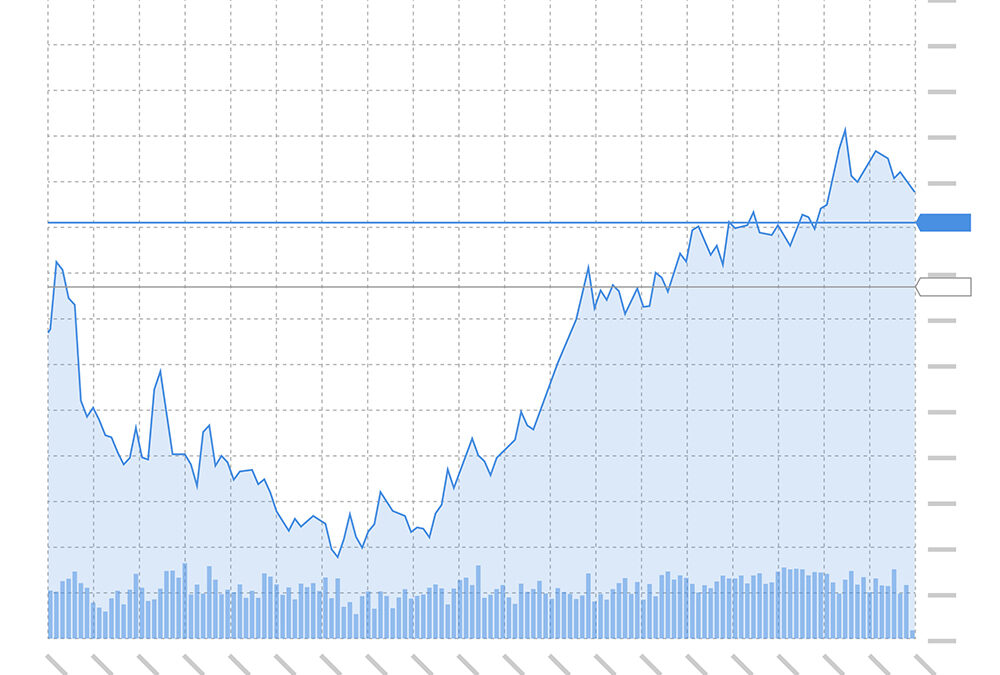

5. Market timing and the best days effect

Like waiting for “the sign”, investors, in general, spend far too much time trying to decide if now is a good time to invest. They wonder about this during good times and bad. The answer is simply yes; it is always a good time to invest simply because we know that the markets are up on average 78% of the time. Market timing doesn’t just involve market lows but also market highs. You have to guess both the top and the bottom in order to successfully time the market. I can tell you that nobody has ever been consistently successful at both, and you won’t be the first. Last year, stocks gained more than 23%. If you missed the 10 best days, that drops to less than 4%, and the same thing for 2023, according to Carson Investment Research. Therefore, you cannot try to guess when is a good time and when is a bad time to invest. You just need to be invested, period. After all, no one ever won the lottery by not playing right?

While this list is certainly not complete, it is indicative of many of the most common mistakes that investors tend to make in times of crisis. By being aware of these mistakes and working hard not to make them, investors can potentially reap big rewards in the future.

Source: Carson Investment Research, YCharts 03/09/2025 (2000-2024). Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS. Reich Asset Management, LLC is not affiliated with Kestra IS or Kestra AS. The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. To view form CRS visit https://bit.ly/KF-Disclosures.

Eric is President and founder of Reich Asset Management, LLC. He relies on his 25 years of experience to help clients have an enjoyable retirement. He is a Certified Financial Planner™ and Certified Investment Management AnalystSM (CIMA®) and has earned his Chartered Life Underwriter® (CLU®) and Chartered Financial Consultant® (ChFC®) designations.