When is a coin not a coin? That is, when is a coin an object not meant to be used for its purpose of buying or spending? I’ve seen many instances of countries, the United States included, that are employing gimmicks in their coinage process to encourage collectors to buy their product. Anything from odd-shaped coins, (remember our mints’ production of the baseball/glove dollar and half-dollar coins that was concave for the glove side and convex for the ball side), bi-metallic coins, colored coins, holographic designed images on coins, coins with the Superman logo, Star Wars and Star Trek characters, etc. I could go on, but the sole purpose is to compete for the collectors’ dollars.

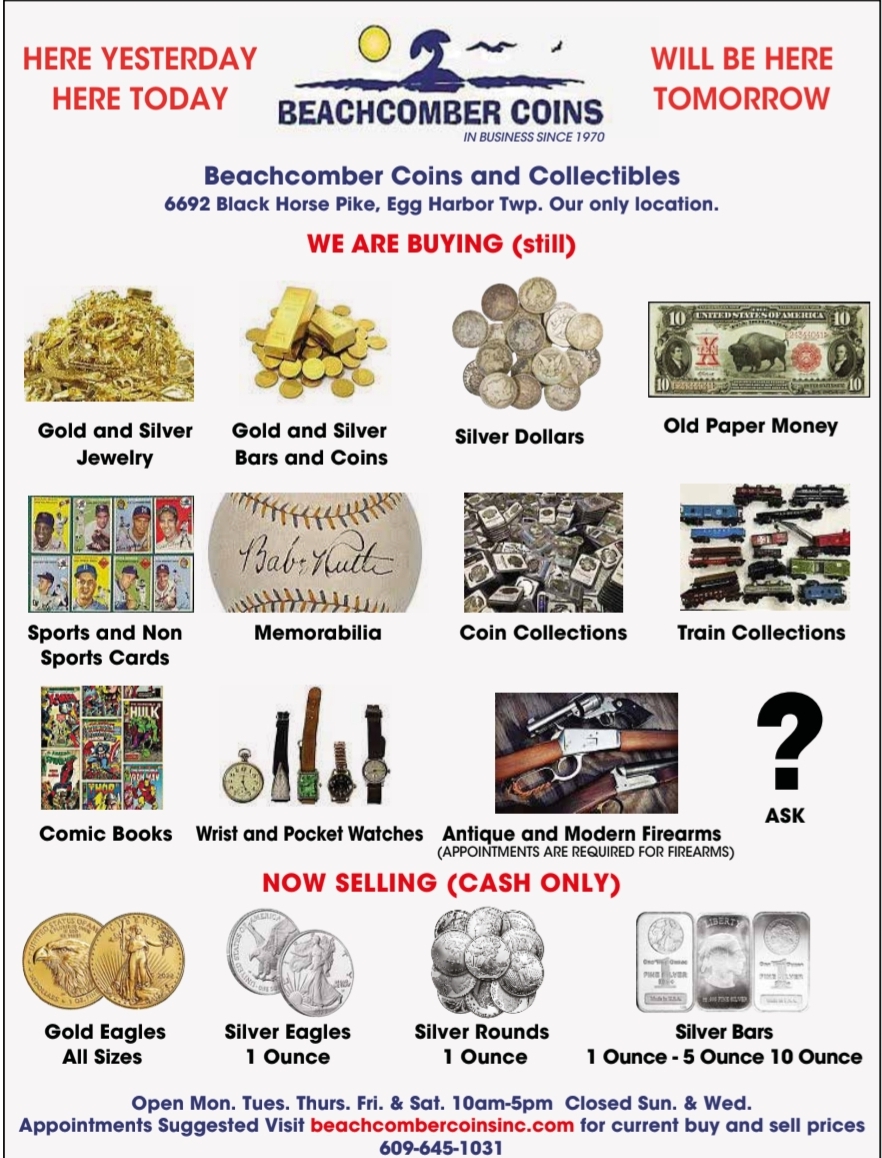

Since these coins are issued under direction and control of the government of the countries that mint the coins, rather than by private mints, they have value in the monetary system of that country shown on that coin. The term for this is non-circulating legal tender. In many cases, but not all, what this means is the coin is struck in a precious metal (gold or silver) whose metal value is higher than the denomination shown on the coin. An example is the United States silver eagle, minted since 1986 and sold as a silver investment and has a face value noted on the coin of one dollar. But since the coin contains 1 ounce of silver which, at this time, is worth around $33, that coin will never be spent for one dollar.

Some coins are sold in fancy boxes with an abundance of paperwork at a premium well above the face value, even in cases where they are not struck in a precious metal, again ensuring they will not be spent as a coin in commerce. However, I remember two instances where countries struck coins in a precious metal when the value was high at the time and with a face value they thought was sufficient, only to have the price of the metal drop to the point it was better to spend the coin. This happened to Panama, whose $100 gold coin, when gold dropped in price, contained less than $100 in gold and hence people tried to spend them. The government’s response was to forbid its use because of the adverse impact on their economy.

The issuance of these coins is meant for one purpose, a revenue stream for the governments, since they are sold to collectors at a substantial profit over cost of production. Consider the commemorative coins and sets the United States Mint has been striking since 1984, now with numerous designs released every year and with issue prices well above the value of the metal they contain.

However, not all commemorative coins that were sold at a premium price over their face value benefited the government. The first commemorative coin struck by the United States Mint was the Columbian half-dollar minted in 1892 for the Columbian Exposition. It was sold to the public for $1, with the extra 50 cents to go toward the construction of the exposition. Commemorative coins were struck in various years from that point forward until the 1950s in denominations of 25 cents, half-dollars, both gold and silver dollars and two and a half gold pieces. They all were meant to be sold at a premium to benefit the construction or support of a monument or event.

Back to these oddball coins now being minted. If they fit in your collection either by topic or design, by all means buy them, but keep in mind one thing, you are buying a collectible, not making an investment, which means you probably will not make a profit over your cost unless the value of their metal content increases.

Douglas Keefe and his wife Linda are owners of Beachcomber Coins and Collectibles in Egg Harbor Township. It is their only location.