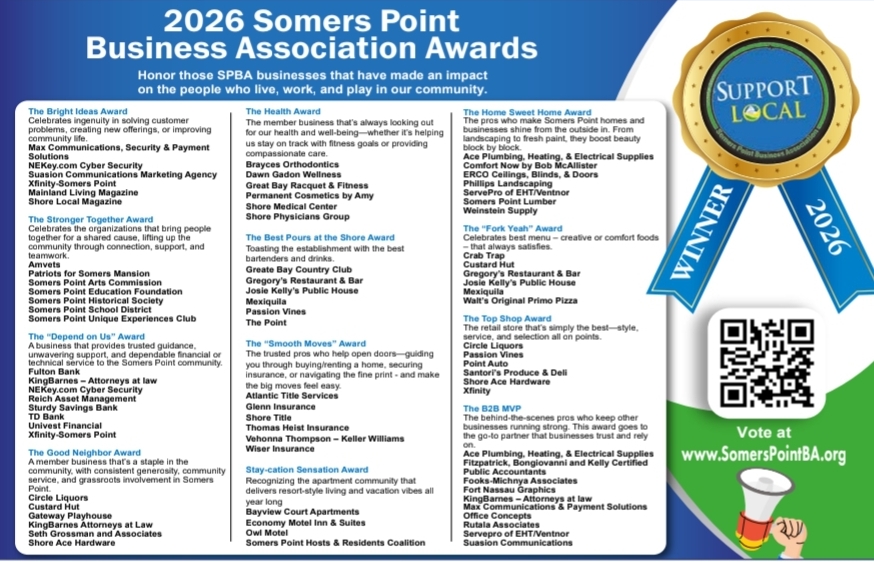

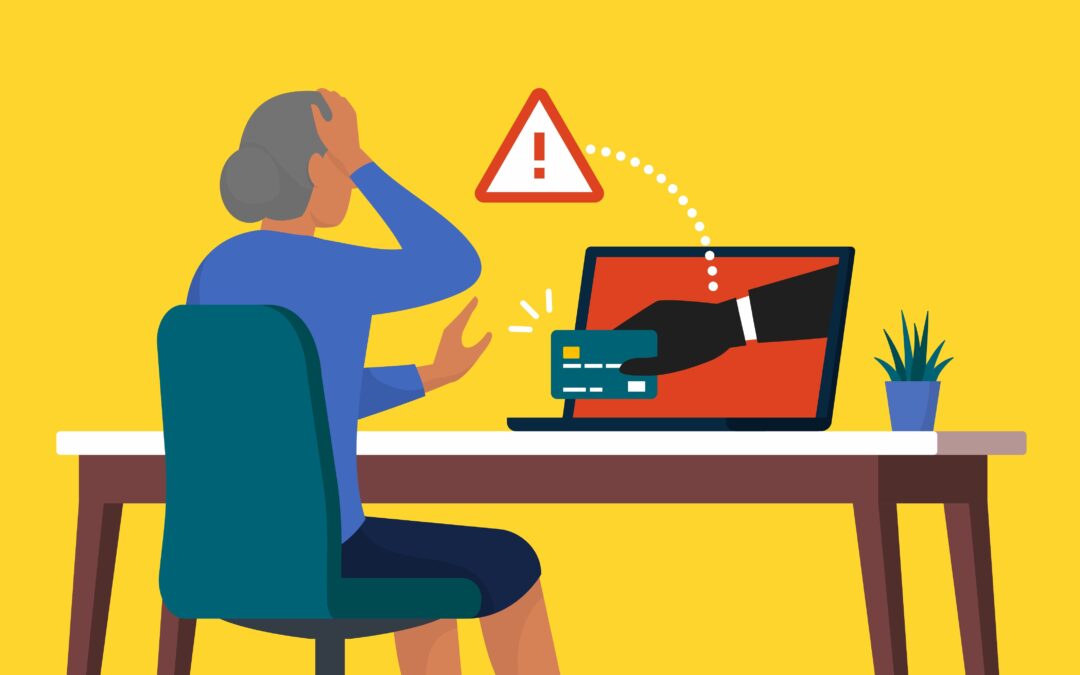

I believe that protecting your financial well-being is a top priority. I’d like to share with you some recent research by the FINRA Investor Education Foundation, which highlights certain factors that can increase the risk of becoming a victim of financial fraud. The good news is that there are steps you can take to protect yourself and your loved ones.

Tips to reduce risk of financial exploitation:

1. Reduce your exposure

Cut off contact before it starts by taking precautions like declining or blocking calls from unknown numbers, deleting messages from unknown senders, saying no to or hanging up on telemarketing offers, and throwing away junk mail. If you suspect a text message or email is spam, block and report the sender.

2. Ignore promises of big rewards

There are no guarantees with investing. Look out for red flags like promises of risk-free investing, guaranteed returns and high profits. Be especially wary if you were solicited for an investment when you weren’t even looking for one. Likewise, competitions and prize drawings, particularly if they require an upfront fee, are often fraudulent.

3. Check out sellers and products

Be alert to signs of imposter investment scams and, before you make any investment, research the seller and the product to make sure they’re legitimate and a good fit for you. You can look up financial professionals using FINRA BrokerCheck to confirm whether they’re registered and/or licensed and view their employment history.

4. Stay connected

If you’re struggling with feelings of loneliness, try to bolster your existing relationships or seek new connections in person, rather than virtually. Unfortunately, random contact from strangers online or via text message is all too often the start of a scam. Reach out to family and friends, if possible, whether in person or from a distance, and look for opportunities to participate in community programs and interact with others.

5. Monitor your emotions

Don’t make investing decisions in a rush or when your emotions are strong. Take time to think things over — or even better, talk over decisions with someone you trust.

6. Practice healthy financial habits

To bolster your sense of financial security, develop a budget for yourself and try to build an emergency fund. If you’re not sure where to start, look for money management webinars and/or financial counseling services offered by banks, libraries, and local nonprofit organizations.

7. Increase your financial knowledge

Having a foundational knowledge about financial products and the basics of investing can make fraudulent offers easier to spot. If you have a brokerage account, make sure you know how to read your account statements, and take steps to protect your financial accounts, like adding a trusted contact.

8. Stay informed about fraud

The more people hear about different scams, the less susceptible they are, which is a great reason to keep learning. Educate yourself about the red flags of fraud and current scams to be on the lookout for. Organizations like AARP and the BBB can help you learn about and track current scams. You can also look for coverage by your local news outlet, or discuss the matter with people you trust.

Where to turn for help:

For questions about your accounts, you can call FINRA’s Securities Helpline for Seniors toll-free at 844-574-3577. If you think you’ve been the victim of a scam, report it to law enforcement. If you’ve been affected emotionally by fraud, there are resources available to help.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS. Reich Asset Management, LLC is not affiliated with Kestra IS or Kestra AS. The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. To view form CRS visit https://bit.ly/KF-Disclosures.

Eric is President and founder of Reich Asset Management, LLC. He relies on his 25 years of experience to help clients have an enjoyable retirement. He is a Certified Financial Planner™ and Certified Investment Management AnalystSM (CIMA®) and has earned his Chartered Life Underwriter® (CLU®) and Chartered Financial Consultant® (ChFC®) designations.