Every Monday, Reich Assets Management, my firm, produces a market week video, where we provide commentary on the previous week and share our thoughts on the week ahead. It has become one of the more popular things we do at our firm. I believe the reason is that people are always trying to figure out where the economy and, subsequently, the markets are heading. I always caution investors that while we can have an opinion on the subjects, everything ultimately is affected by a multitude of factors that could change the markets overnight. That said, here is our firm’s opinion on how we are viewing the economy and markets for 2026.

Personally, I think it is hard to make the argument for a recession in 2026 when you have the policy of the current administration, which includes low tax rates, high deficit spending, and a Federal Reserve that is likely to continue cutting rates. From a policy standpoint, this could be a positive perfect storm for a good economy and stock market. As I’ve mentioned before, I believe the U.S. economy is very much driven by consumer spending. Tax cuts that will reflect in 2025 tax returns should provide extra disposable income for Americans, which may translate into higher spending levels, and as a result, a likely boost to the U.S. economy. The administration’s tariff policy has compressed trade imbalances, but deficit spending has increased to high single-digit percentages, which is an elevated level, especially during times of strong economic growth.

After policy, you have the general economy itself. We are currently seeing solid corporate profits, steady asset prices, and improving global economies, particularly in Asia but also throughout Europe and Australia as well. Tariff fears have subsided, which I’m happy to see, though they are still higher than before. As long as it doesn’t lead to higher inflation, I’m fine with the current tariff levels.

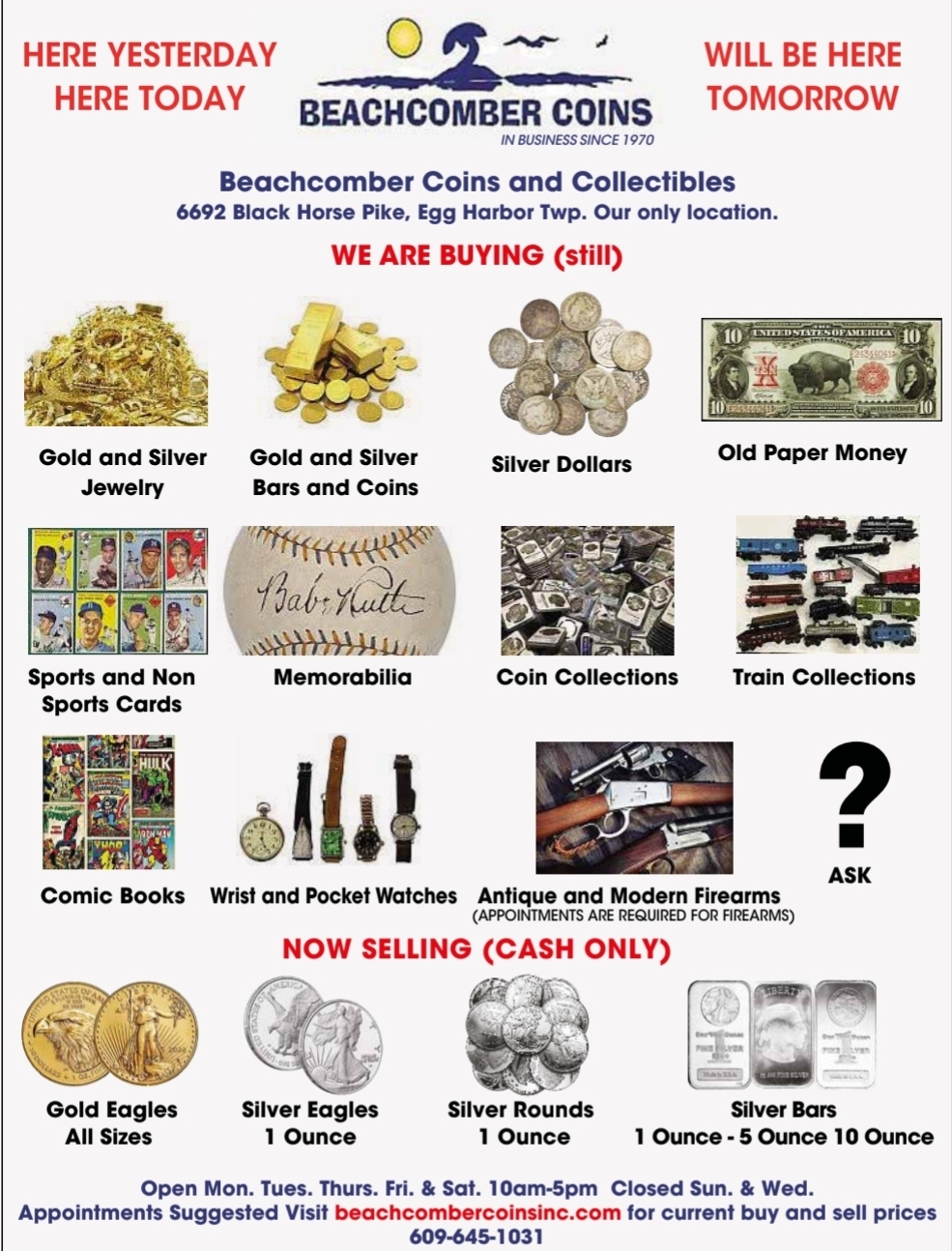

On the investment front, as much as I hate gold as an investment, I think 2026 will still be a positive year for gold. I think after that, the party will likely be over. I like U.S. stocks, particularly larger companies, more than international stocks this year, in what I expect to be a reversion back to the last few years. My guess (obviously no guarantee) is that the market should return somewhere around 12%-14% based on all of the data I mentioned. Obviously, this could change easily, positively or negatively, based on many different factors throughout the year. I think volatility will be higher in 2026 than it was in 2025, and I would not be surprised at all to see a correction at some point during the year above 10%. That said, I think those who ride it out may ultimately be rewarded just as they were in 2025.

I would be particularly focused on diversification in 2026 and not rely on the AI sector to be the driving force again. As is typical, diversification is likely to be your friend in 2026, and over-concentration is not. While 2026 might look ugly at times, in the end, the year-end performance is what really matters, and I intend to stay the course in 2026 through the likely storms we will see.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS. Reich Asset Management, LLC is not affiliated with Kestra IS or Kestra AS. The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. To view form CRS, visit https://bit.ly/KF-Disclosures.

Eric is President and founder of Reich Asset Management, LLC. He relies on his 25 years of experience to help clients have an enjoyable retirement. He is a Certified Financial Planner™ and Certified Investment Management AnalystSM (CIMA®) and has earned his Chartered Life Underwriter® (CLU®) and Chartered Financial Consultant® (ChFC®) designations.