By Eric Reich

One question that we have been getting a lot lately from clients is, “Is now a good time to buy a house?”. To answer this question, like many big decision questions, it depends on your situation. Given the dramatically higher interest rate environment we are currently in, buying real estate brings a lot of deep considerations. The considerations include the following.

1. Do you need to move or just want to? This example is probably the least appealing to me given current housing prices and high interest rates. If it isn’t a necessity, just make sure you understand the issues around buying today.

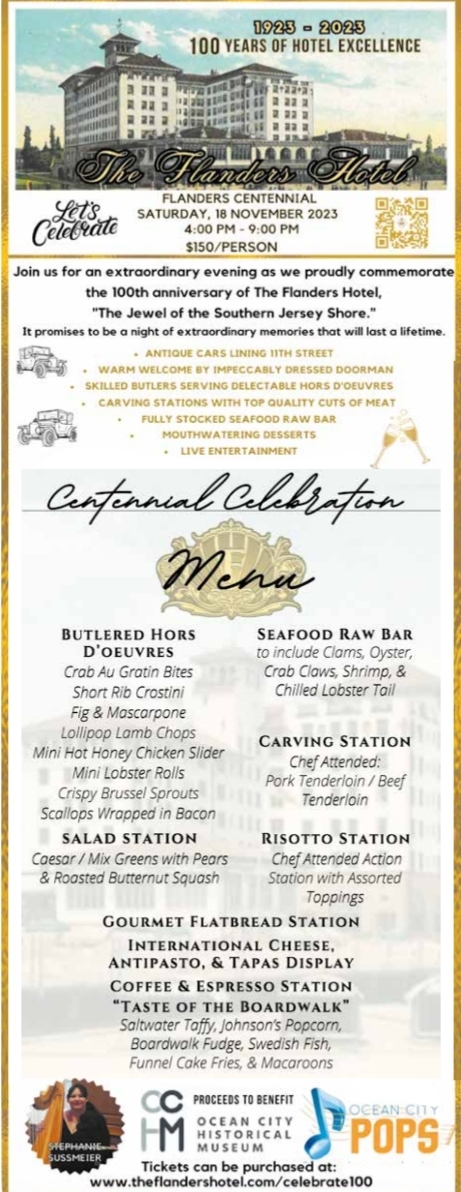

2. Where are you buying? Current prices in Ocean City, NJ look very different than Des Moine, IA. The location, as always, place a huge factor in your decisions, and what you’ll spend.

3. How long will you be there? I hear a lot of people feel reluctant to buy because prices are high. While I understand that, if you intend to occupy the home for the next 20+ years, then I wouldn’t be as concerned about buying a home. While real estate can be a great investment, a long-term primary residence really shouldn’t be viewed strictly through the lens of a return on investment.

4. Interest rates. This is the most common argument I hear for people not to buy now. While the recent surge in rates can have a big effect on your mortgage payments, I expect that interest rates may fall and potentially by a lot in the next few years. This may create an opportunity to refinance those mortgages. Don’t pass up a great house based on current rates alone.

5. Job Stability. Before making any major financial decision, make sure you are prepared, which includes assessing your employment stability. The whole reason rates are high is because the Federal Reserve is trying to slow the economy. If you are in a job that can be sensitive to economic declines, make sure you are easily able to cover your mortgage payments. Given the high interest rate environment, now isn’t the time to stretch yourself too thin financially. Often when this happens, we turn to credit cards more, and at these high interest rates, that can exacerbate the problem.

Lastly, and I have written about this extensively previously, don’t try to go it alone. Real estate agents are professionals that can help guide you through this process. Rely on their expertise to help find you the right property at the right price. Their insights can be invaluable and well worth the cost associated with their advice.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS. Reich Asset Management, LLC is not affiliated with Kestra IS or Kestra AS. The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. To view form CRS visit https://bit.ly/KF-Disclosures.

Eric is President and founder of Reich Asset Management, LLC. He relies on his 25 years of experience to help clients have an enjoyable retirement. He is a

Certified Financial Planner™ and Certified Investment Management AnalystSM (CIMA®) and has earned his Chartered Life Underwriter® (CLU®) and Chartered Financial Consultant® (ChFC®) designations. A lifelong resident of Cape May County, Eric resides in Seaville, NJ with his wife Chrissy and their sons ,CJ and Cooper, and daughter Riley.