Real Estate Matters

By Elisa Jo Eagan

Buying a first home is like embarking on a grand adventure. Although thrilling, learning the ins and the outs of the process can often seem overwhelming.

From determining a budget to obtaining a mortgage, there are numerous factors to take into consideration along the way. Keep these five tips in mind throughout the journey:

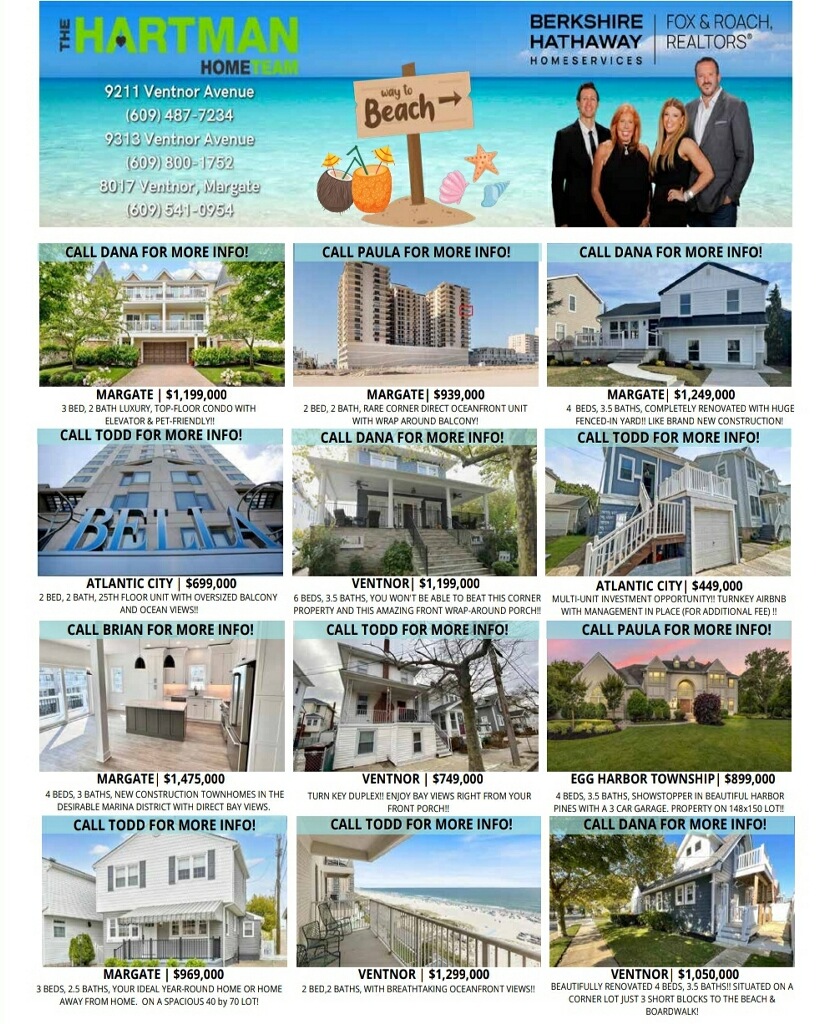

Work With an Experienced Real Estate Agent

Having an experienced real estate agent is important. A quality real estate agent will take the time to fully understand you, listen to your needs, requirements, your specific search criteria and will guide you through every step of the first-time home-buying process.

You will be surprised how much easier it is when you work with a real estate agent who looks out for you; who will cheer you on, protect you and help to save you money wherever possible.

One of the many resources offered by your real estate agent is the ability to suggest the best options of qualified professionals to assist you in the home-buying process, and most importantly, put you in touch with a local, experienced mortgage company representative to make financing your dream home possible.

Check Your Credit Score

Your credit score impacts various aspects of your life, especially when it comes to buying a home. It is a determining factor in being approved for a mortgage with the best interest rate.

Credit Karma offers free credit reports and a phone app which can help you keep track of your accounts, monitor your credit and catch what might be negatively affecting your credit score. Keep in mind that Credit Karma is an estimate of your actual credit score.

Having a good mortgage company representative is your best bet for explaining your credit score in greater detail and advising you on how to improve your chances of obtaining the best mortgage loan possible.

Be Realistic About What You Can Afford

When setting a budget, it’s important to be realistic. To keep your head out of the clouds, consider making a master list of the necessities such as the number of bedrooms, baths and square footage, and a separate list of the extras such as hardwood floors and a modern kitchen that you are willing to compromise on. Many first-time buyers update their home piece by piece, creating the ultimate dream home a little bit at a time.

Gather All Necessary Documents

To get prequalified for a mortgage, lenders typically require various documents. It is advantageous to collect pay stubs, bank statements, and W-2s from the past two years. Ensuring your paperwork is organized will eliminate having to scramble every time your lender requests additional information.

Get Pre-approved for Your Loan

Once your credit score is deemed acceptable and the required documents are submitted, you will be able to begin the pre-approval stage. Being pre-approved allows you to submit an offer with confidence and puts you on an equal footing with competing bidders.

As with any adventure, the destination is the most rewarding part. Take the time to enjoy it. You only get to be a first-time homebuyer once.

Happy home hunting.

There are up to $15,000 in grants available to qualified homebuyers. Call or text Elisa Jo Eagan, the Real Estate Godmother, at 609-703-0432 for details. For real estate information and advice, see www.TheRealEstateGodmother.com.